top of page

All Posts

FROM THANKSGIVING LEFTOVERS TO CHRISTMAS JACKPOT !

If this happens, we go straight from cranberry sauce to champagne. Another event like this one wrapped in a bow, historically worth 15-25 % in the over the next 12 months.

Tom

Nov 26, 20252 min read

Time !

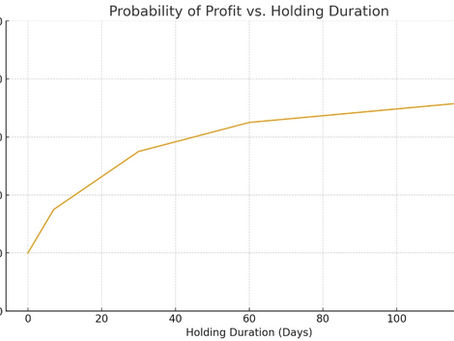

Time is a weapon. It's up to us to use it in our favor, or against ourselves. Choose the wrong timeframe for your trades and it becomes your fiercest adversary, magnifying risk and igniting emotional chaos. Master it, and time morphs into your greatest ally, giving rationality the upper hand over impulse. Picture this: you buy calls that expire in a few days or even the same day 0DTEs. The promise of fast money is intoxicating. But reality hits hard and fast. Short-dated opti

Tom

Nov 26, 20252 min read

The very hungry AI

“The Very Hungry Caterpillar” is a famous children’s book by Eric Carle. My 3yo daughter loves it. It's about a tiny caterpillar that hatches from an egg and is insatiably hungry. Over the course of a week it eats bigger and bigger amounts of food, getting fatter and fatter until it builds a cocoon. After a while it emerges transformed as a butterfly. I decided to name this report/article “The Very Hungry AI,” It starts small but is eating everything in sight growing explosiv

Tom

Nov 25, 20257 min read

When all you hear is "Valuations, valuations, valuations"...

Keep in mind money managers can be pretty average and LAZY !

Tom

Nov 23, 20252 min read

Weekly Market Review & Outlook – November 17–21

What a week , huh ?

Tom

Nov 22, 20253 min read

Be prepared: 2026 Market outlook.

We need to start preparing ourselves for what could come in 2026. I'm not implying i can see the future, but data and ongoing macro and fundamental conditions can tell us what could be the potential risks and how to be prepared. Don't expect from me a price target for the S&P. I'm not competing against major firms, I didn't do it last year, nor the year before and I've been outperforming not just the markets (but also those same firms). My goal, and job as an analyst, is to b

Tom

Nov 19, 20258 min read

We are much closer to a local bottom than a top

Most investors watch the Nasdaq 100 or the big tech stocks when they want to know if the market is healthy or in trouble. There is a much more powerful (and much less known) tool that professional traders and hedge funds watch instead: The daily net number of Nasdaq stocks going up minus the ones going down.

Tom

Nov 18, 20252 min read

October gave us Voltober. November Gives Us… Turnvember ?

At the beginning of October i shared a forecast, the title of it was: October or VOLtober ? I alerted the potential of increased volatility and aggressive price moves in both directions. Happened as expected. Now , its time to show you what November might end up doing next. As of the market close on Friday, November 14, the S&P is down modestly for the month, with a so far month-to-date price return of approximately -1.72% This price action has surprised many, basically becau

Tom

Nov 16, 20253 min read

Sometimes bulls like to disguise as bears

Yesterday , and actually the last couple of days, my subscribers have been getting a lot of information regarding whats going on right now in the markets. From breadth, to macro, to volatility among other critical stuff. But considering the amount of noise out there, and even PANIC ! I decided to publish this briefing OPEN AND ACCESIBLE TO EVERYONE. Believe it or not. Recent price action is unequivocally bullish price action, and the setup-wise it’s one of the cleaner “higher

Tom

Nov 15, 20252 min read

$NVDA Earnings forecast

As NVIDIA gears up to release its third-quarter fiscal 2026 earnings on November 19, investors and traders are buzzing with anticipation. In this report i highlight what believe is the most critical factor to monitor this quarter and beyond, along with potential stock price implications.

Tom

Nov 14, 20253 min read

$QQQ What i thing could come around the corner.

Recently i shared my thoughts on the current setup I'm seeing. From macro (liquidity analysis) to technical (momentum reset).

Tom

Nov 12, 20251 min read

$META Technical review

Technical review

Tom

Nov 9, 20251 min read

S&P $SPX Technical review

As shown on the $SPX daily chart, recently the lower band and the 50MA (purple dotted line) has been a strong support for the $SPX, actually it has been the "bounce off" area. And to me, that is going to be the case once again. Key indicators to monitor closely , specially after what we saw last week in terms of breadth, are: the McClellan Oscillator, the % of stock above their 50MA and the advance/decline line. We need to see breadth improving rapidly. We could see a combina

Tom

Nov 9, 20251 min read

Macro > fundamentals > technicals

Im going to tell you the ONLY "formula" that will lead you to a complete and realistic understanding of the dynamics shaping the stock market ! The ONLY "formula" that will lead you to sustainable profits and performance.

Tom

Nov 8, 20256 min read

$SPX S&P Technical review

In the following article im going to share my thoughts regarding the ongoing pullback, and also where price could found a solid support.

Tom

Nov 7, 20252 min read

When the Fed stops draining the punchbowl: How the end of QT could refill risk appetite

During this weeks FOMC , the Fed announced an important shift. And no, it wasn't the 25bp rate cut.

Tom

Oct 31, 20254 min read

$BA earnings review

Boeing released its earnings before market open. Overall, the results beat revenue expectations but missed on earnings, underscoring a company in transition: improving top-line momentum but grappling with profitability hurdles.

Tom

Oct 29, 20252 min read

FOMC forecast

I expect a 25 basis point reduction in the federal funds target range. This would lower the current 4.00%–4.25% to 3.75%–4.00% marking the second cut of the year following September’s initial easing. Market pricing via the CME FedWatch Tool reflects a staggering 99% probability of this exact outcome. Inflation is cooperating enough to allow this move, disinflation still alive and well. September’s CPI rose 0.3% monthly, pushing the annual rate to 3.0% up slightly from August’

Tom

Oct 29, 20252 min read

Earnings forecast $META

$META stands at the epicenter of tech’s AI and advertising renaissance. With a market cap exceeding $2 trillion and shares trading around $734, Meta’s results will spotlight user engagement, ad monetization, and escalating AI investments amid a robust digital economy. Here's what i expect: Based on my analysis, $META is set for a Q3 double beat with $50.5B revenue and $5.80 EPS, propelled by AI enhanced ads, user scale, and FoA efficiency. Q4 guidance of $53B–$56B revenue and

Tom

Oct 26, 20254 min read

Earnings forecast $AMZN

$AMZN earnings report arrives at a pivotal moment for the tech sector. As one of the “MAG7,” Amazon’s results will not only reflect its own resilience but also signal broader trends in consumer spending, cloud adoption, and AI infrastructure investments. I’m expecting $AMZN to deliver a double beat in Q3 2025, surpassing both revenue and EPS estimates. My forecast of $179B in revenue edges above the $177.8B consensus, driven by strong AWS growth (~$32.5B), resilient ecommerce

Tom

Oct 26, 20254 min read

bottom of page