FOMC forecast

- Tom

- Oct 29, 2025

- 2 min read

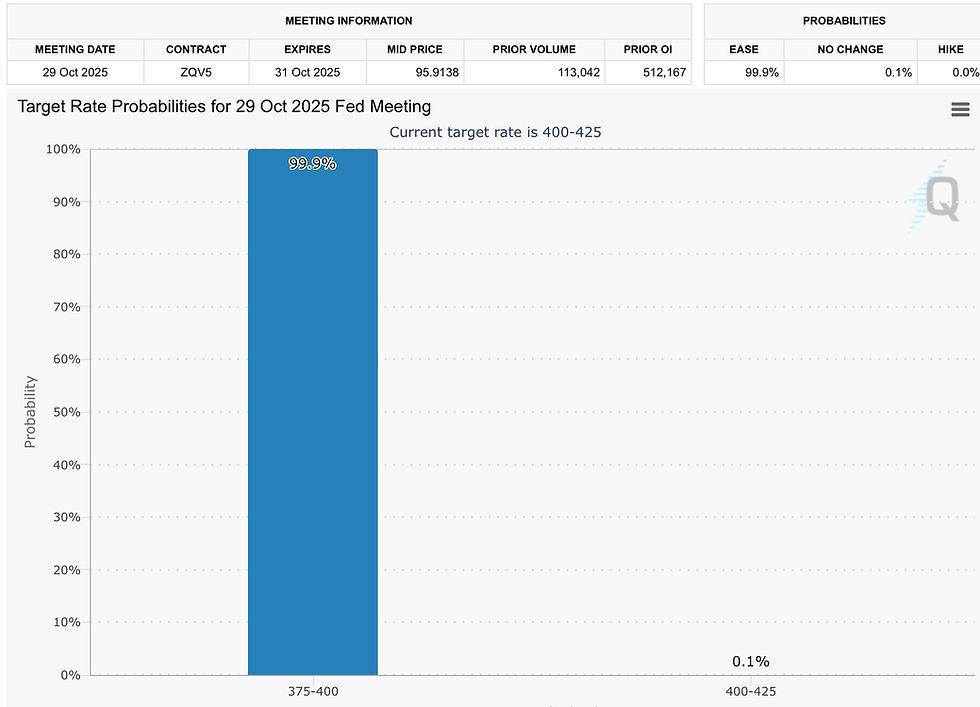

I expect a 25 basis point reduction in the federal funds target range. This would lower the current 4.00%–4.25% to 3.75%–4.00% marking the second cut of the year following September’s initial easing. Market pricing via the CME FedWatch Tool reflects a staggering 99% probability of this exact outcome.

Inflation is cooperating enough to allow this move, disinflation still alive and well. September’s CPI rose 0.3% monthly, pushing the annual rate to 3.0% up slightly from August’s 2.9% but still the lowest since March 2021 for core PCE at 2.7%. The Fed views this as “sufficient progress” toward its 2% target, with long term expectations anchored and tariff-related pressures dismissed as largely one off by most fed members.

Powell statement will likely retain September’s “risks roughly in balance” but soften inflation language to “inflation has eased and is moving toward 2%,” deleting hawkish anchors like “attentive to risks on both sides.” Watch the Implementation Note for QT hints: “Reviewing the appropriate pace” could flag an end to balance sheet runoff (currently $25B Treasuries/$35B MBS monthly) as soon as December, injecting ~$5B–$10B monthly liquidity.

The US. economy is growing at a solid 3.8% annualized pace in Q3, inflation has cooled to 2.7% core PCE and consumer spending remains resilient. So why the cut?

It's called being preemptive. The labor market is softening faster than the headlines admit.

• Job openings have fallen 7.7% YoY (JOLTS).

• Continuing unemployment claims are up 11%.

• ADP private payrolls added just 12,000 jobs last month, a sharp miss.

• State level initial claims are ticking higher in key regions like manufacturing-heavy Midwest states.

These aren’t recession signals yet , but they’re yellow flags. A 25 basis point cut is the Fed’s calibrated response to a resilient yet fragile economy: jobs need shielding, inflation is tamed enough, and data voids demand prudence. labor risks are there, inflation is cooperating, and the Fed has the luxury of patience.

As i said on previous posts, the key question we -as market participants and analysts- should be asking ourselves: is this weakness just a balancing act in the labor market (cooling off from a very hot labor market) or are signals that a deeper deterioration will take place ? This will be the question that will define market and economy performance in 2026.

Don't ignore the QT element. This alone could trigger a rally into EOY.

Comments